Notification of transition to the simplified tax system - sample filling. Notification of transition to the simplified tax system - sample completion On approval of document forms

A notice of transition to the simplified tax system is a document that must be filled out and submitted to the Tax Inspectorate if you are an entrepreneur or the head of a small company and want to switch to the “simplified” system. First, check whether your company meets the conditions that the legislation imposes on taxpayers for the simplified tax system. If everything is in order, proceed to filling out the form in accordance with our recommendations (pay attention to the notification deadlines!).

To switch to the simplified tax system, a legal entity or individual entrepreneur submits to the Federal Tax Service inspection at the place of registration a notification according to the order of the Federal Tax Service of Russia of November 2, 2012 No. MMV-7-3/form No. 26.2-1 recommended. We will look at a sample of filling out a notice of transition to the simplified tax system from 2019 in this article. You must submit it before December 31, 2019.

However, this still requires meeting a number of criteria.

If you are an individual entrepreneur and:

- the number of people working in the company is less than 100;

- you do not use the Unified Agricultural Tax;

You can safely switch to this special mode.

If you are the head of an organization and:

- your number of employees is less than 100;

- income for 9 months of 2019 will not exceed 112 million rubles when working on the simplified tax system (clause 2 Article 346.12 of the Tax Code of the Russian Federation);

- the residual value of fixed assets is less than 150 million rubles;

- the share of other companies in the authorized capital is less than 25%;

- the company has no branches;

- your activity does not relate to the financial sector (banks, insurers);

- earnings for last year amounted to less than 150 million rubles (clause 4 Art. 346.13 Tax Code of the Russian Federation),

you will be able to use the simplified tax system from 2019. To do this, you need to find out what form 26.2-1 is (you can download the 2019 form at the end of the article) and fill it out without errors.

How to receive a notification

The notification nature is a distinctive feature of the transition to the simplified tax system. But this does not mean that you need to receive a notification about the transition to the simplified tax system from the tax service. Quite the opposite: you inform the Federal Tax Service of your intention to use the simplified tax system in the next calendar year. Previously, there was a notification form about the possibility of using a simplified taxation system - this form served as a response to the taxpayer’s application. But it lost force back in 2002 by order of the Federal Tax Service of Russia N MMV-7-3 / Now there is no need to wait for permission from the tax authorities to use the “simplified code”. Send notification of the transition to the simplified tax system yourself. If for this you need a sample of filling out the notification of transition to the simplified tax system-2019 (form 26.2-1), it can be found at the end of the article.

There is also no need to confirm the right to use this regime. If you do not meet the conditions, this will become clear after the first report, and only then will you have to be financially responsible for the deception. The tax service has no reason to prohibit or allow the transition to a simplified system; its use is a voluntary right of taxpayers. In addition, the notification of the transition to the simplified tax system of form 26.2-1, which will be discussed in the article, has the nature of a recommendation. You can inform the Federal Tax Service of your intention to use the special regime in another, free form, but it is more convenient to use a ready-made one. Therefore, you can download the notification form for applying the simplified tax system in 2019 directly in this material.

Notice deadline

You can switch to a simplified tax system from the beginning of a new calendar year—the tax period. If you plan to use this system from 2019, have time to find a sample of filling out a notification about the transition to the simplified tax system from 2019 for individual entrepreneurs and legal entities, fill it out and send it to the territorial body of the Federal Tax Service before December 31, 2019. More precisely, until December 29 inclusive, since December 31 is a day off, Sunday. If you are late, you will have to postpone the transition to the simplified tax system for a year. prohibits the application of the regime to firms and entrepreneurs that have violated the deadline for submitting a document.

How to fill out a notice of transition to the simplified tax system 2019 (form 26.2-1): step-by-step instructions

The recommended form was introduced by order of the Federal Tax Service of Russia dated November 2, 2012 N MMV-7-3/ “On approval of document forms for the application of the simplified taxation system.” Newly created companies and individual entrepreneurs submit a notification using the same form, only they attach documents for registration to it. Newly created enterprises have the right to inform the Federal Tax Service about the application of the simplified tax system within 30 days from the time they register.

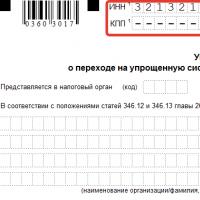

This is what the blank form looks like:

Guidelines for completing Form 26.2-1

Let's look at how to fill out the form line by line. Let us note the differences that are important to take into account when entering data about organizations and individual entrepreneurs.

Step 1 - TIN and checkpoint

Enter the TIN in the line - the number is assigned when registering a company or individual entrepreneur. Entrepreneurs do not enter the checkpoint - the code for the reason for registration, since they simply do not receive it during registration. In this case, dashes are placed in the cells.

If the notification is submitted by an organization, the checkpoint must be affixed.

Step 2 - tax authority code

Each Federal Tax Service Inspectorate is assigned a code, which is indicated when submitting applications, reports, declarations and other papers. Firms and individual entrepreneurs submit forms to the inspectorate at the place of registration. If you don’t know the code, you can look it up on the Federal Tax Service website. Using the example, the code of the Interdistrict Inspectorate of the Federal Tax Service No. 16 for St. Petersburg.

Step 3 - taxpayer attribute code

At the bottom of the sheet is a list of numbers indicating the taxpayer’s characteristics:

- 1 is placed when submitting a notification by a newly created entity along with documents for registration;

- 2 - if a person is registered again after liquidation or closure;

- 3 - if an existing legal entity or individual entrepreneur switches to the simplified tax system from another regime.

Step 4 - company name or full name of the individual entrepreneur

The entrepreneur enters his full name and fills in the remaining cells with dashes.

If you are the head of a company, then enter the full name of the organization. Fill in the remaining cells with dashes.

Step 5 - the number in the line “switches to simplified mode” and the date of transition

Specify one of three values. Each number is deciphered below:

- 1 - for those who switch to the simplified tax system from other taxation regimes from the beginning of the calendar year. Don't forget to enter the year of transition;

- 2 - for those who register for the first time as an individual entrepreneur or legal entity;

- 3 - for those who stopped using UTII and switched to the simplified tax system not from the beginning of the year. Does not apply to all UTII payers. To switch from UTII to simplified taxation in the middle of the year, you need reasons. For example, stop activities that were subject to UTII and start running a different business.

Step 6 - object of taxation and year of notification

Enter the value corresponding to the selected taxation object:

- The simplified tax system “income” is taxed at a rate of 6% - expenses cannot be deducted from the tax base. Regions may lower interest rates starting from 2016. If you chose this type of object, put 1.

- The simplified tax system “income minus expenses” has a rate of 15%, which regions have the right to reduce to 5%. Expenses incurred are deducted from income. If the choice is “income minus expenses”, put 2.

Be sure to indicate the year in which you are submitting the notice.

Step 7 - income for 9 months

Enter the amount of income for 9 months of 2019; for an organization it cannot exceed 112,500,000 rubles for the right to apply the simplified system in the future period. This restriction does not apply to individual entrepreneurs.

Step 8 - residual value of the OS

The residual value of the organization's fixed assets as of October 1, 2019 cannot exceed 150,000,000 rubles. There are no restrictions for individual entrepreneurs.

Step 9 - Full name of the head of the company or representative

In the final part, indicate the full name of the head of the company or his representative, who has the right to sign papers by proxy. Don't forget to indicate by number who signs the form:

The entrepreneur does not need to write his last name in this line; put dashes.

Step 10 - phone number, date, signature

Please provide a contact number and the date the notification was submitted. The form must be signed by the entrepreneur, head of the company or representative of the taxpayer.

The rest of the form is filled out by the tax authority employee. Form 26 2 1 (filling sample for individual entrepreneurs 2019 and legal entities) is drawn up in two copies. One is returned to the taxpayer with the signature and seal of the Federal Tax Service. This is confirmation that you have informed the tax authority of your intention to switch to a simplified tax system starting next year.

So. Since you have reached this page, you can assume that the choice of tax regime has been made and this is the Simplified Taxation System.

An application for transition to the simplified tax system in form No. 26.2-1 must be submitted to the tax office along with other documents for opening an individual entrepreneur or LLC. If you didn't do this, it's okay.

The law allows this application to be submitted within 30 days after submitting the main package of documents.

Example on fingers:

On October 15, 2016, Valery registered an individual entrepreneur, but did not know about the website Assistant.ru and therefore chose the wrong tax regime. On November 30, 2016, friends persuaded Valery to submit an application to switch to the simplified tax system to the tax office, which he did. On January 1, 2017, Valery becomes a full-fledged individual entrepreneur using the simplified system.

If you are switching to the simplified tax system from another tax regime, then the simplified tax system will only “turn on” from the first of January of the year following the year of filing the application. The main thing is to have time to submit the document from October to December of the current year.

Application form for transition to the simplified tax system (according to form No. 26.2-1)

First of all, download the blank form.

Below you will find a complete guide to filling out this application.

FILES

All the benefits of the simplified tax system once again

- the opportunity to legally conduct business without paying personal income tax of 13%;

- the tax on property used in the activities of an entrepreneur is leveled;

- forget about VAT;

- ease of calculation. We pay either 6 percent of total income, or 15 percent of income minus expenses.

By the way! When they say that the simplified tax system replaces the entire tax burden placed on an entrepreneur, they are lying. Personal income tax from employee salaries, please pay on time in accordance with the law.

When switching to a simplified version, remember the conditions under which you will not be allowed to do this!

- Your company has representative offices and branches (of course, the tax authority has been notified about them accordingly). Those. if you work together with Vitalik in Perm, printing business cards, and in Kazan Maxim and Katya distribute them, this does not mean that you have a Kazan branch and, accordingly, this condition under which the simplified tax system cannot be applied is not relevant.

- You must have less than 100 employees. Officially arranged, of course. There may be one and a half thousand people working for you, but if you work alone for official services, there will be no conditions for not using the simplified tax system. Another thing is that questions will arise about your labor productivity, otherwise everyone would work alone in their company.

- The residual value is more than 100 million rubles. Otherwise, you are too rich to use “simple” modes.

- Other companies should not have a stake in yours that exceeds 25%. This is an irrelevant condition for individual entrepreneurs.

- For the first three quarters of the year in which the application to switch to the simplified system is submitted, income should not exceed 45 million rubles.

- Total annual income should not exceed 60 million rubles.

Attention: in the last two points, the sums 45 and 60 must be additionally multiplied by a deflator coefficient, which changes annually.

Let's start filling out the application according to form No. 26.2-1. By the way, it is according to KND 1150001.

Our application will be submitted by a newly minted entrepreneur, Konstantin Yusupovich Okhtyvo. He decided to switch to a simplified taxation regime immediately from the moment of registration of an individual entrepreneur.

TIN field- everything is clear here without further ado.

(reason code for registration) - the individual entrepreneur does not have it. Don't look, you won't find it anyway. Leave the field empty.

Tax authority code

Below we see the tax authority code. Where can I get it from? It's simple: go to the tax service service (https://service.nalog.ru/addrno.do), enter your address in the field, and you will be given a tax code that is linked to your place of registration. This is what you need to enter in the appropriate field of the form.

We figured out the code.

Taxpayer attribute

Here you need to write one number - the taxpayer’s attribute code.

- - write those who submit an application together with documents for registration of individual entrepreneurs. This is exactly our case.

- — when you register a company or individual entrepreneur again. Those. There were already individual entrepreneurs, then they closed, you open again - then this case is yours. Entrepreneurs who have ceased to be UTII payers also write a two.

- - when switching from another tax regime to the simplified tax system, except for UTII (for them - 2). For example, if you are on the OSN and want to switch to the simplified tax system, then the troika is for you.

- - put by those who submit an application from October to December of the previous year, with the aim of switching to the simplified tax system from January of the following year.

- - those who transfer immediately upon registration. Our option.

- — entrepreneurs who have ceased to be UTII payers. They have the right to switch to the simplified tax system not from January 1 of the next year, but from the 1st of the next month of the current year.

In the next square we put 1 if we choose to pay 6% only on income, and we put 2 in a situation where the choice fell on “income minus expenses”, where we already pay 15%.

A small easy example:

You made a stool, spending 300 rubles on it. Then it was sold for 1,500 rubles. If you choose to pay from “income”, then pay 6% from 1500 rubles - 90 rubles. If you chose “from income minus expenses,” then 15% of the amount (1500 rubles - 300 rubles) - 180 rubles.

In this example, it is more profitable to choose “income”. Now imagine that the amount of expenses would not be 300, but 1000, then 15% would be paid from 1200 rubles, but from 500, and this is already 75 rubles. Compared to 90 on “income” it looks more attractive.

That is why it is important to take a prudent approach to choosing the method of tax payments under the simplified tax system.

The simplest last stage remains.

Year of notification— enter the current one.

Revenue received for nine months- zero, since we are just registering. Why this field was introduced - it is written above - the income of those who switch to the simplified tax system for the first 3 quarters of the current year should not exceed 45 million.

The next line, which is called “residual value of fixed assets,” goes with the same message. We don’t have them, we put dashes everywhere, those who have them put numbers.

We will not have any attachments to the application, so there are three dashes in each cell.

Further according to the sample. Full name again as shown in the image:

1

- if we submit the application ourselves and

2

- if a third party does it for us. Signature, date and seal if you are working with a seal. If not, there is no need.

The fields below are intended for the document of the person - your representative. Accordingly, if you do not use the services of third parties, you do not need to fill out these fields.

The right column is filled in by a tax official.

We must print this application form in two copies! One goes to the tax office, the other must have their stamp - we take it for ourselves! Remember: a document confirming that you are on the simplified tax system may be needed in the future.

The Unified Agricultural Tax (UST) is preferential for those businessmen who are engaged in the production and processing of products in the agricultural sector.

Dear readers! The article talks about typical ways to resolve legal issues, but each case is individual. If you want to know how solve exactly your problem- contact a consultant:

APPLICATIONS AND CALLS ARE ACCEPTED 24/7 and 7 days a week.

It's fast and FOR FREE!

general information

The types of tax regimes are different and can be selected by a businessman independently.

Preferential regimes are taxation systems that can be used if certain conditions are met. One of the systems on preferential terms is the Unified Agricultural Tax.

The following can use the Unified Agricultural Tax regime:

- Companies that produce and sell agricultural products.

Manufacturers and sellers of agricultural products have the right to apply the Unified Agricultural Tax if they use products from raw materials that they themselves produced. Also, the profit received from the sale of products must be, in general percentage terms, higher than the value of 70%.

- Consumer cooperatives.

Cooperatives can choose the Unified Agricultural Tax if they produce and sell products within the circle of cooperative members.

- Fishery companies.

The single agricultural tax can also be used by companies involved in fishing. The conditions of use are: the number of employees in the enterprise is no more than 300 people, the percentage of profit from the sale of caught fish must be at least 70%. Users of the unified agricultural system must carry out their fish farming activities on their own vessels or on the transport leased under a sea charter agreement.

- Village-forming companies.

The terms of use are the following:

- At least 50% of the population living in the municipality must work in the village-forming organization.

- Profit from the sale of products obtained during fish farming activities cannot be less than seventy percent of the total profit received from sales.

- The use of special vessels, which can be rented under special conditions. agreement or is on the balance sheet of the enterprise in the form of property.

Objects of taxation

The unified agricultural tax is calculated from income reduced by the amount of expenses.

The company's income is recognized as profit from the sale of products and other non-sales items of income.

To determine the object of taxation, it is impossible to subtract all existing expenses from the amount of income.

The law defines a specific list of expenditure items, due to which it is possible to reduce the base for calculating the tax:

- Expenses for the purchase or production of fixed assets.

- Costs associated with intangible assets.

- Rent amount.

- Spending on seed material.

- The amount of payment to employees for their work.

- Expenses for ensuring safety at work.

- Contributions to insurance funds.

- Value added tax.

- Overpayments on loan obligations taken for the development or improvement of a business.

- Expenses for servicing machines available on the company's balance sheet.

- Purchase of young animals and birds for their further breeding.

- Expenses that are associated with the need to obtain quality certificates for goods.

- Expenses related to the slaughter of livestock or liquidation of the consequences of an emergency.

What modes can it be combined with?

The single agricultural tax can be paid by businessmen engaged in agricultural production. Also, for example, if an entrepreneur or organization has other types of activities, then the use of unified agricultural tax is possible only if it is used in other areas.

Additional taxes payable

In addition to the main tax, an entrepreneur using the Unified Agricultural Tax regime must pay:

- Land and water tax, as well as tax for subsoil development.

- State duty.

- Transport tax.

- Excise duty.

- Insurance payments.

- VAT (if products are imported from abroad).

Legislation

The tax regime of the Unified Agricultural Tax is described in the Tax Code, in Chapter 26.1, Part 2.

Algorithm of actions

If in advance, before receiving the certificate of registration of an individual entrepreneur or LLC, it was clear that it was possible to use the unified agricultural tax, then it is better to submit the application along with all registration documents.

Package of documents

If you are registering as an individual entrepreneur, you must collect and submit the following papers:

- Passport.

- Codes of types of activities from OKVED.

When registering an LLC you need:

- Minutes from the meeting of founders, which will identify the person authorized to submit documents for registration and determine the taxation regime.

- Company charter.

- Notification of transition to special mode.

If you need to switch to the Unified Agricultural Tax at the moment when the businessman is already working, then you will only need to provide a notification with indicators of profit from the sale of agricultural products.

Conditions of use

Only entrepreneurs and businessmen who meet certain conditions can apply the Unified Agricultural Tax.

If, in the course of doing business, the indicators go beyond the established limits, for example, the number of employees exceeds three hundred units, if the profit from activities in the field of agricultural production decreases and becomes less than 70%, then the businessman is either obliged to choose another suitable special regime, or come to terms with the need to use OSN.

Which authorities should I contact?

The transition is carried out by submitting notification 26.1-1 to the tax authority. Individual entrepreneurs must submit an application to the office at the place of registration. If an entrepreneur is registered in one city, but the business has to be conducted in another entity, then notification of registration on the Unified Agricultural Tax must be submitted to the department at the place of business.

Legal entities must submit an application for transfer to the branch at the place of business.

Rules for filling out an application

The basic and main rule for filling out documents for the tax office is that you need to use only current forms.

Form 26.1-1 can be filled out either electronically or by hand. When printing on a computer, you need to make sure that the printer does not leave streaks on the paper or that it does not run out of ink. Filling by hand also requires special concentration, because... a blot or unclear recognition may serve as a reason for refusing to accept documents.

You can send an application for transfer to the Unified Agricultural Tax:

- Personally.

- Through a proxy with the need to issue a power of attorney.

- By mail indicating that the letter must be received against signature.

- Via the Internet, in particular, through the Federal Tax Service website.

Deadlines

Submit notification of transition to special. mode needed:

- At the time of submitting documents for registration of an individual entrepreneur or LLC.

- In the first 30 days from the date of receipt of the registration certificate.

- At any time before December 31, but the use of unified agricultural tax will begin only on January 1 of the next year.

In case of a forced transition, the Unified Agricultural Tax will be terminated from the next month after the fact of non-compliance with the special is revealed. regime.

Attention!

- Due to frequent changes in legislation, information sometimes becomes outdated faster than we can update it on the website.

- All cases are very individual and depend on many factors. Basic information does not guarantee a solution to your specific problems.

That's why FREE expert consultants work for you around the clock!

The Tax Code of the Russian Federation, under certain conditions, provides for the possibility of using the preferential tax system of the simplified tax system for some taxpayers. Currently, this is the most popular mode among economic entities classified as small businesses. To apply it, you need to submit an application for the simplified tax system to the Federal Tax Service using form 26.2-1.

The legislation establishes the procedure for transition to and what criteria must be met. The transition to the simplified tax system is possible when registering a subject and from other modes. However, in any case, it is necessary to take into account the restrictions defined by the Tax Code of the Russian Federation.

When registering an individual entrepreneur or LLC

The rules of law provide the opportunity to submit an application for the simplified tax system along with registration documents at the time of registration of the taxpayer with the Federal Tax Service.

Attention! It is best to submit an application for the simplified tax system when or when opening an LLC together with the constituent documents. Or within 30 days from the date of receipt of documents on state registration.

If a newly organized company or entrepreneur does not submit an application within 30 days, then they automatically switch to the general taxation system. At the same time, it will be possible to switch to the simplified tax system only from the beginning of the new year.

It is also necessary to take into account that with such a transition to a simplified system, compliance with the criteria for its application (number, amount of revenue and value of fixed assets) is mandatory, even if they were not checked at the very beginning. As soon as they are exceeded, it will be necessary to immediately notify the Federal Tax Service about this within the established time frame and make the transition from the simplified tax system to.

Transition deadlines if the application is not submitted when registering an LLC or individual entrepreneur

Existing taxpayers have the right to change the current taxation regime by submitting an application to switch to the simplified tax system within the time frame established by law.

Attention! The deadline for filing an application for the simplified tax system is December 31 of the year preceding the year in which the simplified tax system began to be applied.

Such business entities must remember that they must comply with the criteria for transition to this system.

- cost of fixed assets;

- as well as the most important criterion - the amount of income received for 9 months of this year.

Then they must be compared with the standards specified in the Tax Code of the Russian Federation, and only after that an application for changing the regime to a simplified taxation system must be submitted to the tax office.

Transition from other tax regimes

Special regime officers who use UTII, and for entrepreneurs also PSN, can use the simplified tax system together with these regimes for certain types of activities. This is possible if there are several types of activities on UTII or PSN, but there are also other areas of work carried out by the enterprise.

Let's look at an example of how to correctly fill out an application form 26.2-1.

At the top of the form is the TIN code of the company or entrepreneur. For this purpose, the field contains 12 empty cells. Since companies have a TIN of 10 characters, the last two cells, which will remain empty, must be crossed out.

At the next step, in the field you need to enter the four-digit code of the tax service where you are submitting the application for simplification.

The code specified in it shows at what point in time the economic entity makes the transition:

- “1” is indicated when the document is submitted along with other documents for registration of a company or individual entrepreneur;

- “2” is indicated by a company or entrepreneur who reopens operations after a previously completed liquidation;

- Also, code “2” should be set by those who make the transition from imputation to simplified;

- “3” is recorded by those subjects who switch to simplification from any other system except imputation.

After this, in the large field you need to write down the full name of the company, as is done in the constituent documents, or full full name. entrepreneur with a passport or any other document confirming his identity.

bukhproffi

Important! This field must be filled out according to the following rules. If the company name is written down, it is entered in one line. If the application is submitted to an entrepreneur, then each part of his full name. is written on a new line. In each case, all cells that remain empty must be crossed out.

The code of the following field will determine in what period of time the transition to simplified language occurs:

- Code “1” is indicated by those entities that are making the transition from January 1 of the next year;

- Code “2” must be entered by those firms and entrepreneurs who submit an application when the entity is first registered, or again after its liquidation and re-opening;

- Code “3” should be written down for those subjects who are forced to switch from imputation to simplified imputation. In this case, next to it is also necessary to indicate the month from which such a transition will be performed.

You might be interested in:

STS income 6 percent: who applies, the basis for calculation, what is reduced by, reporting, examples of calculations

The following column contains the code corresponding to the selected simplified taxation system:

- Code “1” is indicated by those who decided to determine the amount of tax based on the income received;

- Code “2” is recorded by those entities who will calculate tax on income reduced by expenses incurred.

In these columns it is necessary to enter the amount of income that the subject received for 9 months of the year when the application is made, as well as the amount of the residual value of the fixed assets.

If an application to the tax office is submitted by an authorized person, then in the column below you must indicate the number of sheets that are occupied by documents confirming his authority.

The application form at the bottom is divided into two columns. The applicant must provide information only on the left. First of all, here you need to enter the code of the person who submits the document to the inspection - “1” - the business entity itself, or “2” - its legal representative.

After this, complete information about the head of the company, entrepreneur or representative is recorded, the number and signature of the person, and a telephone number for contacts are indicated. If there is a seal, then it is necessary to affix its imprint. All cells that remain blank after entering information must be crossed out.

Attention! If the form is filled out by an entrepreneur, then you do not need to indicate your full name in this column again. A dash is placed in the field.