{!LANG-59b765a629e1ee09a6059e7332fedd0c!}

{!LANG-fa6f660d4d0434383322e23c309967b7!}

{!LANG-67e2c71bc7f7bff1a1f15782ba421a27!}

{!LANG-08cee684be8d24990f35294d6dc1716f!}

- {!LANG-d63eb4332fb314deb633537928d03317!}

- {!LANG-b291bf417f390ff61d73fd8ed2d5c9d4!}

- {!LANG-f1cb11f1e6468eb21a1d83f91c34b933!}

- {!LANG-bfde90f42e1c233a19ebb0c41869483d!}

- {!LANG-75631e3cd8cd3ca0bf77cad952a96674!}

- {!LANG-76aca7bb0d2a56186bd9aa36e02cc09d!}

{!LANG-9e2779a96bc5a2146e8aab48c693fc9d!}

{!LANG-0f1824722e957c6d52023a7dcffb29ed!}

- {!LANG-5eb608d7d95db98a4e12281e03b1bd33!}

- {!LANG-4a19ec9e904c0c53e50006aca7cbad6d!}

- {!LANG-a5be334eba867212400ac222631db407!}

- {!LANG-affe6ecacb8551ee3da24a427b4056c8!}

- {!LANG-db39d7ca065d26f3e233ce95afb30707!}

- {!LANG-b838234b51e12808af05fbbf4278cf3a!}

Unfortunately, this issue is very bureaucratic, i.e. you need to first get the advice of a tax agent on the correct filling of all documents, prepare them, bring them in, stand in line, etc. For many Russians who work and live in tight schedules, such time expenditures are often unacceptable.

At the same time, many Russians do not even suspect that they are entitled to monetary compensation when performing certain transactions. The fact is that the FTS is not obliged to notify taxpayers about such a possibility, you must find out about it yourself and contact the tax authority with properly prepared documents and a well-written statement.

A sample application can be obtained directly from one of the offices of the Federal Tax Service of your city, or on the official website nalog.ru.

What does Sberbank offer?

Providing a personal consultant who will fill out a declaration for you online from the bank's partner, NDFLKA.RU LLC. The bank's clients receive a discount of at least 10% on the services of this company, which are assistance in preparing documents that give the right to receive a tax deduction (from 1499 rubles).

How it works:

- You make an order online from the official website of Sberbank,

- Next, your personal consultant will call you back, who will tell you what documents you need to prepare,

- Next, you photograph or scan documents, and upload them via a secure communication channel for the consultant,

- He checks them and fills out a declaration,

- You submit it via the Internet using your Personal Account on the FTS website or, if you did not receive a password, take it to the tax office. You can receive your money on a Sberbank card.

Now, with the help of a special service of Sberbank, it became possible to return previously paid personal income tax taxes. With the help of the service, you can arrange property and social tax deductions for the purchase of housing and life insurance policies, payment for tuition and treatment, as well as payment of voluntary contributions to a non-state pension fund.

Now you don't have to fill out boring tax returns to get tax deductions.

Tax deduction refund using Sberbank

How is the process going? In short, you leave a request on the website and your personal consultant will contact you to clarify the details, after which he will fill out a tax declaration for you, and if you purchase the "maximum package" of services, then he will send the declaration to the tax office and after the tax audit. the correctness of the information received, you will receive a refund of personal income tax to your card. At the moment, more than 25,000 Sberbank clients have used the service.

According to available statistics, the most popular tax refund is now a property deduction for a buyer of real estate, including a mortgage.

How much does the tax refund service cost?

Let's start with the pleasant. The service is free for customers who use the Sberbank Premier service packages (one 3-NDFL declaration per year) and Sberbank First (the declaration is filled out for you and submitted to the tax office). The minimum cost of the service for other clients is 1499 rubles.

Sberbank launched the personal income tax refund service in partnership with the personal income tax service last year. Over the year, more than 25 thousand Sberbank clients used the paid service, which with its help returned almost 3 billion rubles.

You can get a tax refund if:

- Purchased housing (Possibility to return up to 260,000 rubles for the purchase of housing + 390,000 rubles for paid interest on the mortgage)

- Opened an investment account (IIA) (Possibility to return up to 52,000 rubles per year)

- Transferred money to charity (Ability to return the amount without restrictions)

- Life insurance (Possibility to return up to 15,600 rubles per year)

- Paid for tuition or treatment (Possibility to return up to 15,600 rubles per year)

- Made contributions to a non-state pension fund (NPF) (Possibility to return up to 15,600 rubles per year)

The service is provided by the bank's partner LLC "NDFLKA.RU". Sberbank customers receive a discount of at least 10% on the company's services. Services include assistance in preparing documents that entitle you to receive tax deductions.

Service packages

Maximum package (They will not only prepare the declaration for you, but also quickly deliver all the documents to the tax office. Free for owners of the Sberbank First service package or for 1500 rubles if the Sberbank Premier 2 service package is available). Package cost: 2999 rubles.

Optimal package (You pay 1499 rubles for the optimal package (Free for owners of the service package Sberbank Premier and Sberbank First) and receive from the state up to 650,000 rubles for a mortgage or up to 52,000 rubles per year for IIS, as well as up to 15,600 rubles per year for the costs of training, treatment and insurance)

Minimum package ( Instead of manually filling out the 3-NDFL declaration, you fill out a simple online form. Your personal consultant will answer all your questions about the declaration). Package cost: 499 rubles.

How it works: 4 easy steps

Meet the consultant

After ordering, your personal consultant will call you. He will tell you what documents are needed for tax refunds

Uploading documents

Take photos of documents and upload them via a secure communication channel to your personal consultant

The online service offered by Sberbank for clients for tax refunds when purchasing housing or paying for significant services allows you to get a deduction without leaving your home. To submit documents to the Federal Tax Service, it is enough to register on the portal and upload a photo of the required documents. For clients who have purchased a Premier or First package from the bank, the service will be free.

Taxes take away a significant part of the income of Russian citizens, 13% of the funds earned or received as a result of winnings go to the state account. Now individuals have the opportunity to reimburse the funds contributed to the budget; they can do this on their own, or by resorting to special resources, for example, the tax refund service from Sberbank.

The service for the refund of part of the taxes on personal income paid for the budget is an online resource that allows every taxpayer who has the right to carry out such a procedure to receive a refund without leaving home. The service is provided with the assistance of Sberbank PJSC and the specialized company NDFLKA.RU LLC.

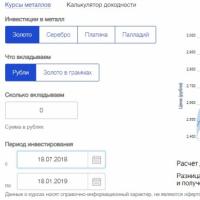

How to find out the refund amount yourself in advance, online calculator

In addition to the maximum amount of reimbursement provided for each category of spending, there are restrictions depending on the amount of tax paid to the budget for the year.

The formula for calculating the tax refund is simple, the payment can reach 13% of the funds spent, while it should not exceed the personal income tax paid for the year. An individual has the right to receive compensation for several types of costs simultaneously. To find out for sure how much it is possible to get from the state, a special online calculator is provided on the Sberbank website in the return section.

To receive the amount due, you need to enter the following information:

- your average monthly salary for the year for which you plan to receive a tax deduction;

- the amount of expenses by category for the purchase of housing;

- payment of insurance, training, treatment, and more.

After displaying all the data, click the calculate button. As a result, the screen will display the amount available for refund according to the specified parameters.

Important! To obtain a reliable result, the information in the calculator must be displayed accurate, preferably based on the available documents.

After the amount is determined, you can go to the section for receiving a deduction on the Sberbank website.

How the service of refund of tax deduction from Sberbank works

To use the services of the service, the client needs to go through a simple procedure for registering a personal account. After filling out the questionnaire, regardless of the package chosen, the client will have the following procedure:

- Preliminary consultation with a personal manager. During it, a company employee will answer all your questions, tell you about what documents need to be collected, and help determine the basis for tax refunds.

- When information on the required forms is received, the client is faced with the task of collecting and providing them. To transfer documents, all papers must be photographed and uploaded to your personal account.

- After receiving the package from the taxpayer, the consultant will independently draw up a declaration based on the data received.

- Depending on the package chosen, the documents must either be submitted to the Federal Tax Service Inspectorate on their own, or the company employees will provide them.

- Further, within 3 months, the tax authorities will consider the received papers and decide whether to grant a refund or refuse. In case of a positive answer, funds will be credited to the specified account within 30 days.

Attention! Together with the submission of the declaration to the tax service, it is also necessary to submit an application indicating the details for the subsequent crediting of the funds due.

What documents may be required

The package of documents that is required to receive a tax refund contains mandatory papers, regardless of the reason giving the right to deduction, among them:

- 3-NDFL declaration;

- 2-NDFL certificate;

- an application of the established form with the indication of the details for the subsequent tax refund, for example, the data of the passbook.

In addition to the completed forms, the Federal Tax Service will have to provide documents confirming the right to deduct one of the expenses, it may be: a mortgage on an apartment, a receipt from a savings bank to pay for an insurance policy, etc.

Attention! If the purchase of a home was made under a consumer loan agreement, it is impossible to refund the tax. .

Every citizen of the Russian Federation who is a payer of personal income tax is entitled to tax deductions. You can apply for a payment at any time after the end of the period for which it is returned, the main thing is to collect a full package of documents and draw up a declaration correctly. Using the services of Sberbank for tax refunds avoids errors in the design of forms required by the state and increases the likelihood of approval.

Higher education. Orenburg State University (specialization: economics and management at heavy engineering enterprises).

June 2, 2018.

As one of the largest banks, Sberbank has the ability to constantly expand the range of services for its customers. In particular, relatively recently, a financial organization offered to the market a service of assistance for tax refunds on various grounds: if there are expenses for studies, purchase of residential real estate, insurance, and so on. This program has significant competitive advantages in speed, convenience and professionalism of delivery. Moreover, the cost of this service is quite affordable for a wide range of consumers.

The procedure for registering a tax deduction through Sberbank

A financial institution provides a service for the return of a part of personal income tax when buying real estate or for other reasons, not independently, but through a specialized company. The function of this organization is the high-quality filling of documents so that they are accepted by the supervisory authority, and then a positive decision was made on them in terms of reimbursing a part of personal income tax.

When making a property deduction, you need to know a fairly large number of nuances. In particular, it is required to correctly calculate the amount of the deduction and the tax itself, correctly fill out all the documents and collect their complete package. If you make inaccuracies in any issues, problems may arise with the return of part of the personal income tax, or the documents will have to be redone, which will require additional time costs.

In addition to collecting and filling out documents, a specialized company also transfers them to the IFTS. When applying for the exercise of the right to deduct to Sberbank in 2018, it should be remembered that the bank and a specialized company provide only information and consulting services. No organization can guarantee a tax refund, since the decision is made by the supervisory authority following the consideration of each package of documents.

Who can get taxes refunded through Sberbank?

Clients of a financial institution have the opportunity to receive money from the state if they meet the following criteria:

- The registration of the purchase of housing was carried out. The maximum amount of the main property deduction is 260 thousand rubles. If an apartment, house or plot of land was purchased using a mortgage loan (for other loans, compensation is not provided), you can return the amount of interest on the loan. In this case, the maximum amount of compensation will be 390 thousand rubles.

- Tuition or treatment was paid for. For these types of expenses, the reimbursement limit is 15,600 rubles per year.

- Life insurance was carried out. The amount of compensation will be the same as for training or treatment.

- There is an open individual investment account. In accordance with the established provisions of regulatory enactments, the owners of such financial instruments have the opportunity to receive a personal income tax return from the state in the amount of up to 52 thousand rubles per year.

- Payments were made to charity. In this case, it is possible to reimburse the entire amount of expenses, there are no restrictions on this matter.

- Participation in the non-state pension insurance program. The presence of these expenses allows you to return up to 15 600 rubles per year.

Stages of personal income tax reimbursement through Sberbank online

To apply for a refund of part of the tax through a financial institution, you need to go to its website and follow the appropriate link. The system will offer to leave an application, in which you must indicate your last name, first name and contact information (phone and email). Next, there are four simple steps to follow:

- Step 1. Communication with a consultant. Some time after placing an order on the site, a specialist will call the client, who will competently explain what needs to be done to receive a personal income tax refund, what documents to collect, where to issue them, and so on. He also has the competencies to answer all your questions.

- Step 2. Uploading documents to the site. All information is transmitted over a secure channel, so their confidentiality will be respected.

- Step 3. Filling in the declaration. Based on the documents received, the specialist will fill out the necessary forms online, which will subsequently need to be submitted to the regulatory authorities.

- Step 4. Submission of documents to the IFTS through the services of a personal account or by personal transfer. You can arrange the maximum package on the Sberbank website, then a specialized company will send the documents to the supervisory authority.

The site also contains a calculator for calculating the amount to be refunded. After the IFTS considers the package provided and makes a positive decision, it remains to wait until the funds are credited to the Sberbank card.

How much does registration cost

A client wishing to carry out this operation can choose one of three packages, depending on their own financial capabilities and qualifications (payment can be made without commission by transferring from card to card):

- Minimum. When choosing this method of cooperation, the consultant will check the correctness of filling out the questionnaire to form a 3-NDFL certificate, and also analyze the correctness of the preparation of documents, which will subsequently be transferred to the IFTS. As a result, the risk of errors will be minimized, due to which a refusal to reimburse personal income tax may be received. The cost of such a package is 499 rubles.

- Optimal. This method of cooperation implies not only the analysis and assessment of the correctness of the submitted forms, but also the transfer of information to the IFTS. The cost of this package is 1499 rubles.

- Maximum. He only requires the client to provide the established documents. The rest will be done by a competent specialist - to check their correctness, fill out a declaration and transfer the entire package to the supervisory authority. The cost of such services is 2999 rubles.

You can, of course, try to solve the problem on your own and save money, but this will also require significant time costs. Therefore, it is better to entrust the preparation of documents to specialists at a very affordable price and engage in their main activities.

Benefits of cooperation with Sberbank

Property deduction for interest on a loan or personal income tax from the cost of housing can be obtained through the Federal Tax Service Inspectorate (which helps a financial organization) or through an employer. Receipt through an employer is faster, but the amount of compensation becomes stretched over time, therefore, if you need a large amount at a time, it is better to contact the tax office.

Making a return on mortgage interest at the expense of personal income tax using the services of Sberbank has the following advantages:

- All operations are carried out online, which avoids the need to visit the IFTS and stay in queues.

- Favorable working conditions. The cost of the optimal package is quite affordable for a wide range of people.

- Highly qualified specialists, which significantly increases the likelihood of receiving personal income tax compensation.

Sberbank allows you to apply for a refund from a purchase through a 3-NDFL declaration. The acquisition of real estate is an important and responsible step in the life of every person. Owning your own brand new apartment brings stability and tranquility, but it entails serious financial costs for repaying the loan over several years. To support the population and stimulate the purchasing power of citizens, the government provides tax deductions to ease the burden of expenses on the taxpayer.

The state monthly takes part of the salaries of representatives of working categories of the population in the form of income tax. The payment amount is 13%. For most, the procedure is carried out without personal participation and filling out 3-NDFL. The accounting department of an enterprise or organization makes settlements with the official bodies, giving the total amount to the employee.

Article 220 of the NKRF regulates the reimbursement of a part of the loan spent on repayment of loans to a credit institution. This allows a person to pay off debts faster, providing additional support to the family budget. It is beneficial for the country to have decently wealthy residents living in comfortable conditions, looking with confidence to the future.

On the websites of the federal government and Sberbank, information is indicated on the availability of the opportunity to receive part of the money spent back for use for personal needs. But the information is of a general nature and does not always take into account the peculiarities of the personal situations of an individual man in the street. There are patterns that help you quickly navigate.

Required package of documents

The main stage is the timely provision of the required papers and the correct filling of 3-NDFL. The specificity of the requested information logically proceeds from the nature of the relationship between the official bodies, Sberbank and the client who bought the apartment on the mortgage. The parties are notified of the ongoing operations.

To analyze and issue a positive decision, the tax service will need:

- A certificate confirming the rights of a citizen to the existing property that is the subject of consideration;

- Real estate purchase agreement between buyer and seller;

- Information on the timely repayment and the amount of interest on the loan;

- Payment schedule issued by a representative of a financial institution;

- Declaration of official income and a certificate from the accounting department on wages;

- Extradition agreement;

- Passport of the Russian Federation proving the identity of the subject of the transaction.

It is worth taking care of the availability of a stock of photocopies along with the originals in advance, convenient sorting and storage of a package of papers for submission to a state institution.

You will not have to deal with bureaucratic red tape to fill out 3-NDFL immediately after applying for a loan. It is easier to return within three years from the date of signing the agreement and moving to. The minimum period for receiving money is one year from the date the first interest is paid to the lender. You can put off copies in advance, plan things.

The Tax Code of the Russian Federation regulates the requirements and basic conditions for state compensation for citizens who have purchased an apartment. Article 220 describes the features and mechanisms of the procedure. It is a legal right to claim a refund of part of the funds spent from payments to Sberbank and other credit institutions.

Regulation by law, and not by the internal rules of a financial company, allows:

- Build a sequence of actions and appeals;

- Have before your eyes an indication of the rights and obligations of the parties;

- Appeal to the responsible authorities to resolve ambiguities and conflicts.

A citizen has not only the opportunity to stabilize his financial situation in a difficult situation, but also the responsibility for the timely and full provision of the requested information, documented through 3-NDFL.

The borrower is required to comply with the deadlines for paying fees to government agencies and Sberbank, without delays and arrears. Delay on a loan also serves as an obstacle to receiving money. To be able to apply and receive a positive decision from the inspection staff of private and public institutions, you must fulfill your own obligations in a timely manner.

Entities eligible for deduction

Persons who meet the conditions specified in the regulations can apply for a refund of part of the costs of buying an apartment on a mortgage. The main criteria will be the absence of debts to the responsible parties, the payment of taxes on the territory of the Russian Federation and the receipt of an official registered income.

To receive money, you must meet the following parameters:

- Be a citizen of the Russian Federation, or work on its territory with the payment of taxes for more than six months;

- To exercise this right for the first time in your life. It is possible to receive the benefit only once;

- Have officially recognized income. Illegal sources of profit without payment of duties will not be taken into account in the calculation;

- Purchase real estate in the mortgage of Sberbank, indicating in the contract the price and parameters of the object, the purpose of the loan.

Those who receive an unaccounted or double salary in envelopes that do not fall into the control base with an empty 3-NDFL, do not deduct income tax at the rate of 13% and cannot claim compensation.

Refusal awaits parents and entrepreneurs in child care who enjoy a special tax regime. Taxpayer status is key. If the person receiving the benefit from the state has a secondary registered source of income and pays the fees, then the right to recover the costs is realized in full.

In addition to reimbursement of interest on monthly expenses, it is possible to compensate part of the funds from the price of the property through filling in 3-NDFL. Only your own money spent is taken into account. Certificates of purchase issued by federal authorities as assistance, preferential payments and are not taken into account.

In case of joint ownership of property, all owners will have to go through the stages of registration individually. Transfer of rights to compensation from one person to another is not allowed. The spouses who took out a loan from, will return only the invested personal savings, taking into account individual earnings and the size of shares in the area for each.

Those who serve in the ranks of the armed forces and equivalent structures should deduct from the forthcoming refunds the amounts received as assistance to improve their living conditions. If the program fully covered their costs at Sberbank, then they will not be able to claim payments. The same applies to regions with housing certificates.

Required documents for obtaining interest on return

The package of required certificates and papers for an apartment is similar to a similar one for monthly payments. It is allowed to submit an application one year after the entry into ownership. There is no limitation period for applying at the moment, but you can get funds only from income for the last 36 months or by submitting declarations for previous years.

In addition to identity and earnings certificates, 2 and 3-NDFL declarations, you will need:

- Application for a return from the purchase of an apartment;

- Purchase and sale agreement or participation in shared construction;

- Extract from the unified register of real estate registration;

- Payment checks and receipts;

- If there are several owners - a request for the distribution of shares, a certificate of the conclusion of a marriage union and the number of children;

Those producing the construction or bringing the object to a residential state will also need data on the costs of construction materials and work.

Law firms, both cooperating with Sberbank and leading independent activities, offer services for the collection, verification and sending of documentation on behalf of the owner. This saves time and effort on bureaucratic red tape, helps to avoid mistakes in filling out, but entails additional costs for services.

Deduction methods

The application indicates how funds will be paid from the return from the purchase of an apartment in a mortgage. There are two choices allowed. A tax of 13% from the monthly salary is not deducted at the place of work and is handed out along with earnings. Or the number of the personal account for transferring money for the year is entered into the form.

The preferences depend on the personal financial situation. Monthly small amounts consistently support the family budget, allowing you to pay off the mortgage interest, or direct it to everyday small expenses. A one-time large tranche can be spent on a large purchase, to pay off the debt.

It is worth considering the need for annual submission of documents for calculating benefits. You will not be able to issue it once and refuse further actions. Reporting requires updating the payer's data on income for the year. With their growth, the amount of compensation will increase proportionally, with a decrease, it will decrease. There is a link to the income tax from salaries.

Procedure and general procedure for return

You will have to wait one year from the start of interest repayment and the receipt of the property in ownership for the system to make the due deductions and enter the data into the databases of official bodies. Earlier, it will not work to get money, but you can spend time collecting documents and finding out the sequence of actions, changes in laws.

- A request is written to the Federal Tax Service about the right to return. A response is pending;

- The current list of requested documents is being updated;

- Papers are collected and photocopied. Sheets are certified by a notary upon request, or personally. To do this, on each page it is written that the copy is correct, a number and a signature are put;

- At the place of work in the accounting department, a certificate is taken. The 3-NDFL declaration is filled out independently or with the help of a consulting firm;

- The collected information is provided to the branch of the tax authority;

- After 30 days, the notice is handed over to the employer, or funds are credited to the specified account, depending on the chosen model of receiving payments.

The order of actions may change due to the presence of errors in documents, delays in responses from authorities, but in general it remains relevant.

Employees of Sberbank and the Federal Tax Service will help explain the incomprehensible aspects of the process. It is in their interests to help a person as a client of a financial institution and a citizen of the country. They cannot do everything completely for the applicant. In case of lack of time, many stages will be undertaken by representatives of private firms specializing in legal support.

Deduction calculation

The taxpayer's income is taken as a basis. The amount of compensation in both cases is equal to income tax of 13%. Restrictions are the size of the salary and the maximum allowable amount - 260 thousand of the cost of housing and 390 thousand of interest on the purchase of an apartment on a mortgage - 13% of 2 and 3 million, respectively. Unpaid money is carried over to the next year.

Not the maximum amount is paid, but the maximum possible relative to the citizen's earnings. An increase in payments is allowed with an increase in income, confirmed by relevant certificates. The date of acquisition of the property plays an important role due to changes in legislation. After 2014, the lost balance is transferred to other purchases.

The most convenient way is to submit information via the Internet in the personal account of the FTS user. You will have to go through the registration process, but in the future there will be no need to visit the branches for processing most of the papers. It is possible to install the program "Declaration" from the website of the tax service, fill out a form in it with subsequent printing.

In the nearest branch of the state structure, the document is filled in independently or with the help of an employee. You will need to specify:

- Personal data;

- Address of the place of residence;

- Requested amounts, income, their source.

Before starting the procedure, individual details should be clarified to be entered into the appropriate points. Special codes are specified with a consultant

Consulting firms offer the services of filling out, checking and sending the 3-NDFL declaration on behalf of the client in electronic form. Clients of the Sberbank Premium and Sberbank First programs have discounts and promotions for the services of partner companies.

Property and tax deductions are the right of those who did not enjoy the return from the purchase of an apartment on a mortgage and the interest of citizens who receive official income and pay taxes and loans on time. You can apply for funds a year after the entry into ownership. Payments are made by the tax service to the specified account or through the employer.

An example of filling out the Declaration of 3-NDFL for mortgage interest