Depersonalized metal account (OMS). The advantages of compulsory medical insurance in Sberbank. Viewing information on metal accounts through your personal account

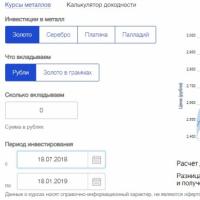

Calculator yield CHI Sberbank of Russia

Bank clients are always interested in the issue of safeguarding and increasing funds. Today financial institutions offer their clients several options for saving and saving:

Deposits in rubles and foreign currency;

Depersonalized metal accounts (OMC) in gold, silver, platinum and palladium equivalent.

Which of the types of savings to prefer - you need to calculate. Choosing the online calculator yield CHI Sberbank of Russia, it is easy to calculate your income for a different period of time, while for each type of metal it can differ significantly. To do this, you only need to set the amount of the proposed deposit and the period for which it will be opened. All other calculations will be performed automatically, and for clarity, the client will be offered a graph of the estimated profitability.

Types of impersonal metal accounts

Before opening OMS in a bank, you need to know that they are of different types:

Current - with the lowest interest rate and generating income for their owners due to changes in the value of the metal. Despite the low percentage, the advantage of such a deposit is that it is unlimited, and you can replenish, as well as withdraw funds from it at any time convenient for the client.

Deposit or urgent - generating income not only due to changes in the cost of the metal itself, but also due to the monthly interest charged. The disadvantage of such a deposit is that you can withdraw funds only at the end of the contract. If this is done ahead of schedule, the interest accrued by the bank will be recalculated at the minimum rate.

Most investors do not chase bank interest and prefer to make money on fluctuations in the value of the metal, while always being able to withdraw their investments when financial stability changes without additional time and nerves. If you calculate the profitability, then it is best to place deposits on the compulsory medical insurance for a long period, since the real income is received not by the depositors due to interest, but only due to fluctuations in the value of precious metals. According to statistics, the best profitability of metal accounts is obtained within 3-5 years, after investing in the account. Over such a long period of time, several rather serious ups and downs in quotations can occur, so potential investors should be patient, which will not be justified as quickly as they would like.

1. Where can I open an impersonal metal account?

An impersonal metal account can be opened in the branches of the Bank and authorized to work with impersonal metal. The list of the Bank's branches can be checked on the website or directly at the Bank's branches. Currently, more than 8,500 branches of the Bank open non-personalized metal accounts, over 500 of them work with physical metal.

2. In what metals is it possible to open unallocated metal accounts?

Opening of impersonal metal accounts is possible in 4 types of metal: gold, silver, platinum and palladium.

The Bank sets quotations for the purchase and sale of precious metals in an impersonal form, taking into account the current discount prices for precious metals established by the Bank of Russia, the situation on the domestic precious metals market, as well as trends in current prices in the world precious metals market.

5. In what units is an impersonal metal account kept?

Depersonalized metal accounts are kept in grams of precious metals.

6. Is there a minimum value for transactions with unallocated metal accounts?

Incoming and outgoing transactions with gold, platinum and palladium are carried out in grams with an accuracy of 0.1 gram, with silver - up to 1 gram.

7. Is it possible to make incoming and outgoing transactions on unallocated metal accounts in other branches of the Bank?

The ability to make incoming and outgoing transactions at the branches of the Bank, not at the place of opening the account, depends on the technical capabilities of a particular branch of the Bank. This information must be specified at the time of opening an account.

8. What is the maximum and minimum amount that can remain on an impersonal metal account?

The minimum amount on the account is "0", the maximum is not limited.

9. Is it possible to perform metal transfer operations between unallocated metal accounts?

The operation of transferring impersonal metal is not provided.

10. Are there any age restrictions for opening non-personal metal accounts?

An unpersonal metal account can be opened by:

- adults, i.e. those who have reached the age of 18 - on the basis of an identity document;

- legal representative of the child (parent, adoptive parent, guardian) in the name of a minor under 14 years of age - on the basis of:

- parent - upon presentation of the child's birth certificate (if the child is not entered in the passport);

- guardian - upon presentation of a document from the guardianship and trusteeship authority on the appointment of a guardian or a guardian's certificate issued by the guardianship and trusteeship authority;

- a capable minor between the ages of 14 and 18 opens on his own, but with the written consent of his legal representative. "

11. Who can perform transactions on the accounts of minors?

- under the compulsory health insurance of a minor, before the age of 14, the operation is performed by a legal representative To carry out expenditure transactions, the legal representative must also submit a written prior authorization from the guardianship and guardianship authority.

The performance of operations under the compulsory medical insurance of a minor under 14 years of age by other persons is possible on the basis of a notarized power of attorney issued by the legal representative of the minor, and, when making expenditure transactions, the written preliminary permission of the guardianship and guardianship authority.

- under the compulsory medical insurance of a minor between the ages of 14 and 18, the operations are performed by the minor himself, but with the written consent of the legal representative drawn up during his personal appeal to the structural unit of the bank in the form of an application on a separate sheet of paper with a signature and date, or on the basis of a notarized consent legal representative.

Compulsory health insurance transactions for a minor between the ages of 14 and 18 are possible by other persons on the basis of a power of attorney issued to a minor with the written consent of a legal representative, drawn up by a notary.

12. Is it possible to issue a power of attorney to manage an impersonal metal account?

A power of attorney to be able to dispose of an impersonal metal account must be notarized.

13. Are impersonal metal accounts insured with the Deposit Insurance Agency?

With the advent of the global economic crisis, the popularity of unallocated metal accounts (OMS) has grown, which is associated with currency instability and inflation. In recent years, the price of gold has been steadily growing, and this confirms the effectiveness of investments in precious metals. At the moment, compulsory medical insurance remains the most popular type of investment.

The bank operates OMS in gold, silver, platinum and palladium. The minimum amount of metal for opening a time account is 50 grams for gold and platinum, 3,000 grams for silver and 200 grams for palladium. The term of the deposit is 367 days, the interest rate is 1% per annum. In case of early termination of the contract, 0.01% per annum is charged. Additional contributions are accepted, the amount of which is not limited. An urgent compulsory medical insurance is opened provided that the client has a current account in rubles and a compulsory medical insurance "On demand".

Demand deposit can be opened for any period, and the amount of precious metal is not limited. Interest is not charged on the balance. OMS "On Demand" in NOMOS-BANK is issued provided that the client has a current account in rubles.

NOMOS-BANK

Clients can open OMS in this bank in gold, silver, platinum and palladium. Interest is not charged to the On Demand account, and the term of the deposit and purchase and sale operations are not limited. The minimum amount of metal to open an account is 1 gram for gold and silver, 300 grams for platinum and palladium.

A term deposit in gold and silver allows you to get interest, which is charged in grams and is 0.1-0.5 percent per annum. The minimum amount of metal for opening a term deposit is 3,000 grams of gold and 300,000 grams of silver.

The bank provides for the withdrawal of funds in the form of bars, but you will have to pay a bank commission and VAT in the amount of 18% of the amount. Opening and maintaining an account with NOMOS-BANK is free. To open a compulsory medical insurance, you only need a passport of a citizen of the Russian Federation and funds to buy the required amount of metal.

A special agreement is concluded for conducting an OMI operation via the Internet bank. Account opening and maintenance is free. To carry out transactions for the purchase and sale of impersonal metal on the Internet, a card in rubles is opened and access to NOMOS-Link is connected.

Sberbank

Traditionally, customer confidence in Sberbank is high, and given that OMI is not included in the deposit insurance system, many investors prefer to open such accounts here.

A depositor can open OMC in gold, silver, platinum and palladium. The minimum size of metal for opening an account and carrying out sales and purchases is 0.1 grams of gold, palladium, platinum and 1 gram of silver. The deposit is issued "on demand" with an unlimited period. The interest rate on the metal is not charged. There is no minimum and maximum account balance, which allows you to pick up metal without closing the account.

It is possible to have several OMC in Sberbank, however, funds are not transferred from one account to another. The deposit and withdrawal of funds in bullion is provided, but in this case, the investor must pay a bank commission and tax in the amount of 18% of the deposit amount. To open a deposit, you must have a passport of a citizen of the Russian Federation. The metal can be purchased from a bank for cash, by transfer from another account, or deposited in bullion.

In the course of the transaction, an agreement is signed for the opening and maintenance of OMS. Money or ingots are exchanged for impersonal metal at the exchange rate of Sberbank at the time of the transaction and are credited to an account, the opening and closing of which is free of charge. The client is given a second copy of the contract and a savings book, which indicates the amount of metal.

OMS quotes in Sberbank are set at 9:30 and 19:30. Each bank branch has its own quotes and spreads, it is necessary to take this feature into account before signing the agreement. You can follow the quotes on the official website of Sberbank.

Investors making transactions in excess of 1,000 grams of gold, platinum, palladium and 60,000 grams of silver can count on customized quotes that are available at any time.

URALSIB

The bank offers to open a term deposit or "On demand" in gold and silver. For registration, you need a passport of a citizen of the Russian Federation. It is possible to withdraw metal from the account in the form of ingots.

The interest rate on a term deposit depends on the term of the metal on the account: for 181 days, 0.20% per annum is charged, for 271 days - 0.30% per annum, and for 367 days - 1% per annum. The minimum contribution weight is 10 grams of gold, 1,000 grams of silver. Account replenishment and contract renewal are not provided. In case of early termination, interest is not charged.

Demand deposit does not provide for the accrual of interest. The minimum weight of the metal is 10 grams of gold and 1,000 grams of silver. It is possible to replenish the account in an amount of a multiple of 0.1 grams of gold and 1 gram of silver. The term of the deposit is not limited.

VTB 24

The bank offers OMS in gold, silver, platinum and palladium. The minimum specified size of the metal for a purchase and sale transaction is 0.1 grams of gold, platinum, palladium and 1 gram of silver. No interest is charged on the account balance. There is no minimum minimum balance, which allows selling metal without closing the account.

The bank can open several accounts for one name. The client has the right to transfer precious metal from one account to another, provided that they are open in the same metal. The purchase and sale is carried out at the rate set by VTB24.

The opening and maintenance of OMS is free, and the term of the deposit is not limited. To open an impersonal account, you will need a passport of a citizen of the Russian Federation and one more identity document. You can replenish OMS by transferring metal from another anonymized account or by purchasing it from a bank. All operations are carried out without the participation of physical metal: the reception and delivery of ingots when opening or closing an account is not provided.

Benefits of compulsory medical insurance

The advantages of compulsory medical insurance over the physical purchase of metal is that when conducting transactions with an impersonal account, VAT is not paid in the amount of 18% of the value of the metal. Moreover, its price is as close as possible to the level of the world market, because the price does not include the manufacture, transportation and insurance of ingots. In addition, the investor does not need to rent a cell for storing ingots.

The indisputable advantage of OMC is in the free opening and maintenance of an account. Many banks do not limit the minimum initial and additional contributions. And the sale of metal from an impersonal account is carried out on the day of circulation. Some banks allow the withdrawal of metal in the form of ingots, but in this case, you will have to pay VAT (18%) and bank commission. Sometimes a non-cash transfer of metal from one OMS to another, opened in the same bank, is provided.

Disadvantages of metal accounts

OMS are not included in the deposit insurance system. Against the background of recent events in Russia, this is a significant disadvantage of this type of investment. If the bank's license is revoked, the account holder joins the general queue of bank creditors and waits for the sale of his assets.

The banks set quotes for the purchase and sale of metal on their own. In this case, the spread (the difference in price between buying and selling a precious metal) is 3-5 percent. But in case of unforeseen circumstances, for example, a sharp increase or decrease in demand, the spread can increase significantly, because there are no restrictions, and the decision is made by the bank.

OMC does not make the investor the actual owner of the gold. Some banks provide for the possibility of physical withdrawal of metal from the account, however, the owner pays VAT in the amount of 18% of the amount and the bank's commission, which is not regulated by anyone and is set by the financial institution independently. This means that in a situation that can provoke a massive withdrawal of physical metal from the account, the bank has the right to establish a commission in the amount of even 50% of the value of the bar.

Recently, there has been a tendency for paper gold to exceed physical gold. This could theoretically lead to the fact that the owners of physical gold do not want to sell it on deliverable futures and the markets for paper contracts will stop. As a result, the owners of such contracts will simultaneously want to cash them out, and the physical metal will not be enough to cover the obligations. In addition, banks will be able to set arbitrary spreads and commissions for the withdrawal of metal into physical form. Therefore, despite the advantages of compulsory medical insurance, one should not forget about the possible investment risks.

After the opening of the OMC, the cost of investments immediately decreases by the value of the spread, and in order to reach at least a zero indicator when selling the metal, one must wait until its value increases by the amount of the spread. Based on this, it is recommended to open OMS for the long term.

Interest on urgent compulsory medical insurance, as well as income received from changes in metal prices, are subject to income tax at the rate of 13%. In the first case, it is held by the bank, and in the second, the responsibility lies with the account holder.

Over the past two to three years, VTB 24 metal accounts have become especially relevant. This service has its own characteristics that should be taken into account when making a deposit. "Metal" investments are not covered by insurance, therefore it is best to open such accounts in reliable banks. VTB 24 is the largest bank in the Russian Federation, which is a state structure and has a large authorized capital.

Depersonalized metal accounts VTB

The most common deposits during the economic crisis are investments and storage of funds on. They have identical conditions with the classic deposit in rubles. The main difference is only that the accounting is not in rubles, but in grams of metal.The following metals are available to open OMS: silver, gold, platinum, and palladium. You can use internet banking to manage your account.

Price (rate) of metals for today - dynamics over the past years

Viewing information on metal accounts through your personal account

If you have access to, you can open and close the OMC, as well as view the necessary information online.If it is more convenient for you to contact the employees, then here you can also get the necessary information and expert advice.

Legal entities can open a metal account with VTB by signing the necessary documents. In this case, the investor's card must be notarized. This document must contain the name of the organization, details of its bank accounts, copies of basic documents, etc.

As soon as the procedure for opening a metal account with VTB is successfully completed, the depositor will receive a document confirming this operation.

Account maintenance at VTB 24

The main conditions for cooperation between the bank and the client are prescribed in the agreement. Any actions on the accounts are subject to a commission, the amount of which will depend on the type of metal, type of deposit, etc.Conclusion

When opening a metal account VTB 24, it is important to remember that you will not be able to get rich instantly. For a tangible increase in income, you will have to wait several months or even years. Despite this, this type of investment does not lose its popularity.Gold price dynamics

Dynamics of silver prices

Platinum price trends

Palladium price trends

CHI management strategies

There are at least two approaches to conducting CHI: the conservative approach of the investor and the modern approach of the speculator.

Investment strategy the most simple: an urgent compulsory medical insurance is opened and the investor calmly waits for the end of the period specified in the agreement, after which he receives or does not receive income from the exchange rate difference and in any case receives interest income. The agreed term of the deposit partly relieves the investor from the worries associated with the natural desire to take advantage of the current favorable situation in the precious metals market and make a profitable transaction. But it may turn out that during the expiration date of the contract on the urgent compulsory medical insurance, the prices on the market change in an unfavorable direction, which can bring serious losses to the investor, and the interest income may not even cover.

Speculative strategy maintaining an impersonal metal account implies opening a demand account and making transactions for the purchase and sale of impersonal metal at suitable short-term moments of a decrease or increase in the price of metal. This strategy makes sense if the investor manages to get an income higher than on a regular deposit in the same bank. This approach may prove to be the most profitable, but using it requires some skill in estimation and forecasting.

As has been said many times, the most serious drawback of this investment tool and at the same time, the greatest risk for the investor is lack of insurance of unallocated metal accounts in... OMS are not subject to Federal Law No. 177 - FZ of December 23, 2003 " Insurance of deposits of individuals with banks of the Russian Federation”. This means that if the bank in which you opened the CHI goes bankrupt or its license is revoked, your deposit will not be covered by the insurance claims of the "Deposit Insurance Agency" and the investor will be included in the general queue of bank creditors. This fact requires you to carefully choose a bank for opening an OMS, otherwise you risk losing everything.

As has been said many times, the most serious drawback of this investment tool and at the same time, the greatest risk for the investor is lack of insurance of unallocated metal accounts in... OMS are not subject to Federal Law No. 177 - FZ of December 23, 2003 " Insurance of deposits of individuals with banks of the Russian Federation”. This means that if the bank in which you opened the CHI goes bankrupt or its license is revoked, your deposit will not be covered by the insurance claims of the "Deposit Insurance Agency" and the investor will be included in the general queue of bank creditors. This fact requires you to carefully choose a bank for opening an OMS, otherwise you risk losing everything.

Having opened an impersonal metal account, you are the nominal owner of the precious metal in the specified amount. In reality, gold bars will not be added to the bank's vault - the bank does not purchase precious metals for the purpose of physical collateral on impersonal metal accounts.

The bank spread for the purchase and sale of precious metals is not legally regulated. The bank can set a spread that is too large, which will lead to a decrease in the investor's income or even losses. Usually, banks use this tactic in cases of a sharp change in the market price of the base metal or an increase in price volatility.

The amount of the commission for the issue of physical precious metal in ingots is also not regulated by law and is determined by the bank depending on the current market situation. Accordingly, nothing prevents the bank from overstating the fee.

Answer the question "are unallocated metal accounts profitable?" it is impossible without touching upon specific investment conditions such as the investment period, precious metal, time of purchase of metal, etc. To assess the attractiveness of this tool, you need to own much more information and conduct an assessment in a complex. Well, if you are impressed by a speculative strategy, then your income depends, to a greater extent, on your skills and ability to predict economic indicators.